- As Social Security marked its 89th anniversary, the program faces looming fund depletion dates.

- Lawmakers have suggested tax changes, including eliminating taxes on benefits or raising how much the wealthy must contribute to the program.

- Here's what those changes would mean for benefits.

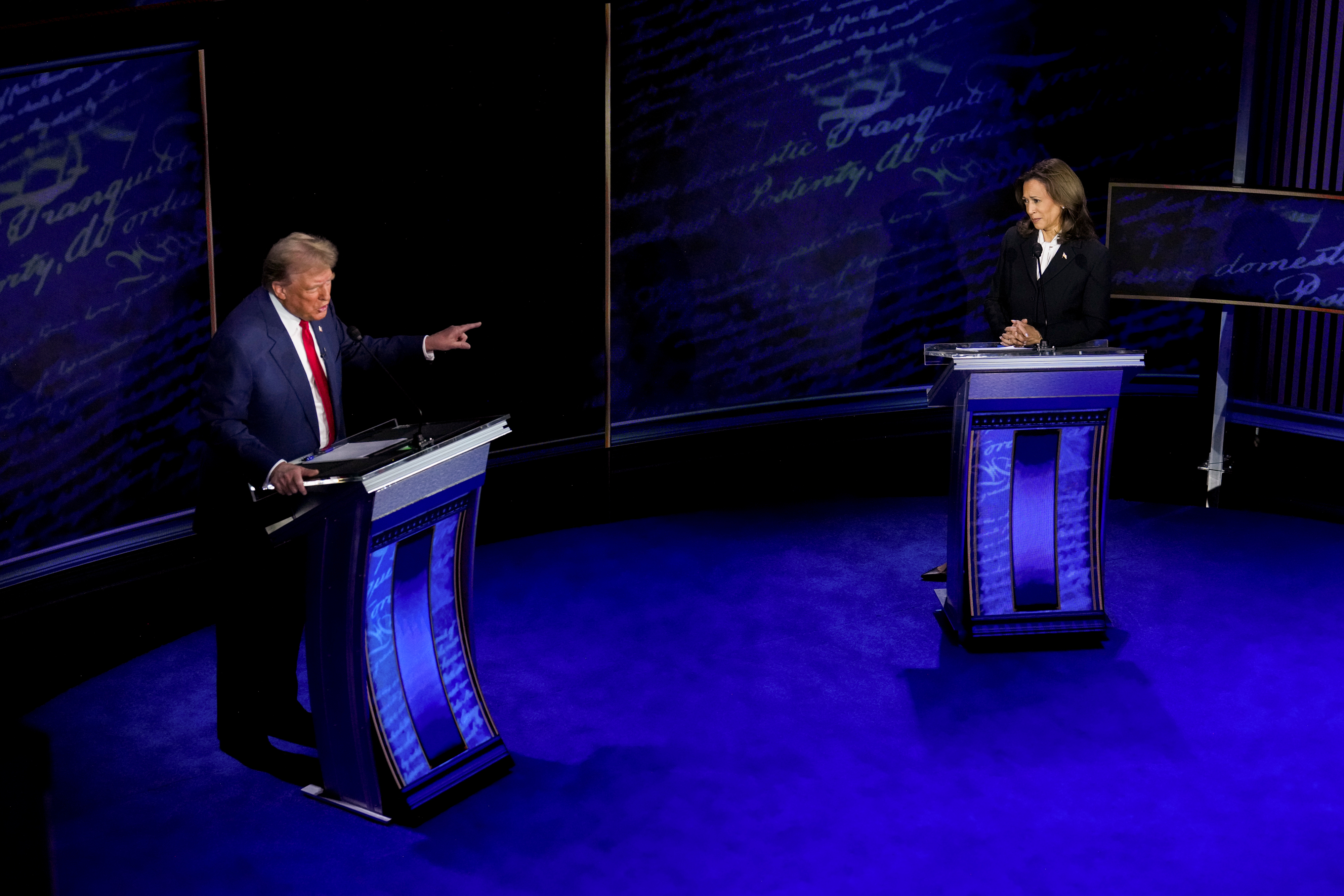

Former President Donald Trump has touted a bold new idea for Social Security: ending taxes on benefit income.

"Seniors should not pay tax on Social Security," Trump wrote on July 31 in all capital letters on social media platform Truth Social, and repeated the point during an Aug. 7 Fox & Friends interview.

While the change would let beneficiaries keep more of their monthly checks, Trump's plan has a "fatal mistake" in that it doesn't make up for the revenue that would be lost, Rep. John Larson, D-Conn., told CNBC.com in an exclusive interview.

Get top local stories in Philly delivered to you every morning. Sign up for NBC Philadelphia's News Headlines newsletter.

More from Personal Finance:

Social Security cost-of-living adjustment may be 2.6% in 2025

Record backlog leads to $1.1 billion in improper Social Security payments

How retirement 'super savers' amass the biggest 401(k) balances

"He comes out and says he's going to have a tax break but doesn't say how he's going to pay for that," said Larson, who is ranking member of the House Ways and Means subcommittee on Social Security. "In essence, his proposal would end up cutting the Social Security trust fund."

Voters say Social Security is a 'top' election issue

On Wednesday, Social Security reached the 89th anniversary since President Franklin D. Roosevelt signed the program into law.

U.S. & World

Stories that affect your life across the U.S. and around the world.

The program now faces an uncertain future, as its combined trust funds are projected to run dry in 2035. At that time, unless Congress acts sooner, beneficiaries may see an across-the-board 17% benefit cut.

The program's trust fund that pays retirement benefits is due to run out even sooner, in 2033, risking a 21% cut to those benefits.

Social Security's future is "one of the top" or a "very important" issue in how voters plan to choose candidates in the November presidential election, a new CNBC poll finds.

"I believe, from my conversations with lots of people on both sides of the aisle on Capitol Hill, that there's the will to actually examine this and extend it for many, many years to come," Social Security Commissioner Martin O'Malley told CNBC "Squawk Box" on Wednesday.

Social Security fixes likely to include tax changes

Trump is not the first to suggest the elimination of taxes on Social Security benefits. One Democratic bill introduced in January in the House of Representatives — the You Earned It, You Keep It Act — likewise calls for excluding Social Security benefits from gross income for federal income taxes.

If enacted, the bill would save the typical senior household almost $560 per year, the Senior Citizens League, a non-partisan senior group, recently estimated.

But the move would increase federal deficits by $1.6 trillion to $1.8 trillion through 2035, non-partisan public policy organization Committee for a Responsible Federal Budget, found in a recent analysis of Trump's idea. Moreover, it would increase Social Security's 75-year shortfall by 25%.

A Trump campaign spokesman did not return a request for comment by CNBC.

Larson is instead touting a broader reform package — the Social Security 2100 Act — that would broadly make benefits more generous and pay for those increases by imposing higher taxes on the wealthy.

The bill would include a 2% across-the-board benefit increase, as well as more targeted increases for lower-income seniors, widows and widowers and students. The proposal would also eliminate current rules that result in reduced benefits tied to public servants, known as the Windfall Elimination Provision and Government Pension Offset.

To pay for those changes, the bill calls for raising the Social Security payroll tax thresholds for wealthy earners. In 2024, up to $168,600 in earnings are subject to those levies. The bill calls for reapplying the tax on earnings over $400,000. It would also apply a higher net investment income tax rate for those higher earners.

Altogether, the bill's provisions could help extend the program's ability to pay full benefits by 32 years, the Social Security Office of the Chief Actuary estimated last year.

The Social Security 2100 bill has been reintroduced in various sessions of Congress. Larson, who is running for reelection, said he plans to reintroduce it again in the next session.

While the current version has 188 Democratic co-sponsors, Larson said he hopes for the backing of two other notable leaders — Democratic presidential candidate Kamala Harris and her running mate, Tim Walz.

As senator, Harris was a co-sponsor of a bill that similarly called for making benefits more generous while raising taxes for the wealthy. As vice president, the White House administration likewise called for expanding Social Security and taxing the wealthy.

Meanwhile, Walz was an original co-sponsor of Social Security 2100 during his time as a congressman representing Minnesota, according to Larson. As governor of Minnesota, Walz increased the state tax exemption for Social Security benefits.

The Harris-Walz campaign did not return a request for comment from CNBC.

While Republicans have considered other changes to Social Security — such as raising the retirement age — Larson hopes he can eventually lure leaders from the other side of the aisle to support his proposal.

"We're going to lift the cap on people [earning] over $400,000 and the other side says, 'Here you go again. It's tax the wealthy,'" Larson said. "No, it's have them pay their fair share."

In congressional hearings on the program, Republican lawmakers have raised concerns about the costs associated with reforming the program. Ultimately, restoring Social Security's solvency may require a compromise including both tax increases and benefit cuts.

Rep. Jodey Arrington, R-Texas, commended Larson for his passion and for putting a proposal on paper during an April Ways and Means Social Security subcommittee hearing.

"Even if I disagree, and in some cases wildly disagree, with his way of solving it, we're going to have to get in a room and we're going to have to hold hands and leap off the cliff of those who criticize us who do anything to reform the program," Arrington said.

While critics question whether lawmakers will bring the bill forward for a vote, Larson said he hopes to see progress on Social Security in the next Congress or in the coming lame duck session.