The S&P 500 ended Tuesday just short of a new closing record, while the tech-heavy Nasdaq Composite climbed to an all-time high as bitcoin staged an intraday comeback.

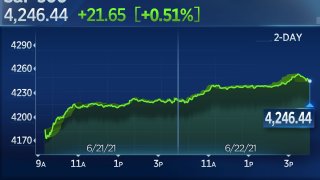

The blue-chip Dow Jones Industrial Average gained 68.61 points to 33,945.58 after posting its best day since March on Monday. The S&P 500 climbed 0.5% to end the day at 4,246.44 while Nasdaq erased earlier losses and climbed 0.8% to hit a fresh intraday record and finish at 14,253.27.

Bitcoin endured another wild session that saw it break below $30,000, only to later turn green on the day. At one point Tuesday, the world's largest cryptocurrency wiped out all of its 2021 gains. Tesla, a bitcoin holder, climbed as the digital token bounced off its low. The electric vehicle company was up nearly 0.5% at the end of the day.

Get top local stories in Philly delivered to you every morning. >Sign up for NBC Philadelphia's News Headlines newsletter.

Major technology shares led the market rally Tuesday as Netflix climbed 2.3%, while Amazon, Apple and Microsoft all gained at least 1%. Facebook jumped 2%. Alphabet shares turned higher even after the European Commission opened a probe into Google's advertising unit.

On Monday, the blue-chip Dow gained 580 points for its best day since March 5 as shares tied to the economic recovery snapped back from last week's sell-off induced by the Federal Reserve's updated projections on inflation and interest rate hikes.

"This is a precarious time — stocks have gone a relatively long period without any major sell-off, and there is heightened sensitivity to every utterance from the Fed as it attempts to transition to the start of normalization," Invesco chief global market strategist Kristina Hooper said in a note.

Money Report

Fed Chairman Jerome Powell is testifying before the House of Representatives Tuesday on the central bank's response to the pandemic. His remarks, which were released ahead of the hearing Monday evening, supported the notion that the Fed is ready to soon start discussing removing some of its unprecedented stimulus measures enacted during the pandemic.

Indexes hit their highs of the session as Powell answered questions from House members. There was no headline from Powell that looked to be clearly responsible for the gains, but the Fed chief was bullish on the economic comeback and maintained that inflation forces were temporary. There also could have been some relief buying from traders worried that Powell would be a bit more hawkish on rate increases than the central bank was last week.

"Since we last met, the economy has shown sustained improvement," Powell said Tuesday, according to the Fed release. "Widespread vaccinations have joined unprecedented monetary and fiscal policy actions in providing strong support to the recovery. Indicators of economic activity and employment have continued to strengthen, and real GDP this year appears to be on track to post its fastest rate of increase in decades."

"Inflation has increased notably in recent months," Powell said. But the Fed chief noted that most of those are a temporary effect and that inflation should settle back to 2% over the long term.