Stocks rallied Monday to start the new month and quarter, as Treasury yields eased from levels not seen in roughly a decade.

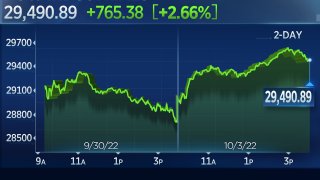

The Dow Jones Industrial Average ended the day 765.38 points, or nearly 2.7%, higher at 29,490.89. The S&P 500 rose about 2.6% to 3,678.43, after falling Friday to its lowest level since November 2020. The Nasdaq Composite advanced nearly 2.3% to end at 10,815.43.

It was the best day since June 24 for the Dow, and the S&P 500's the best day since July 27.

Get top local stories in Philly delivered to you every morning. >Sign up for NBC Philadelphia's News Headlines newsletter.

Those moves came as the yield on the 10-year U.S. Treasury note rolled over to trade at around 3.65%, after topping 4% at one point last week.

"It's pretty simple at this point, 10-year Treasury yield goes up, and equities likely remain under pressure," Raymond James' Tavis McCourt said. "It comes down, and equities rally."

Wall Street is coming off a tough month, with the Dow and S&P 500 notching their biggest monthly losses since March 2020. The Dow on Friday also closed below 29,000 for the first time since November 2020.

Money Report

The Dow shed 8.8% in September, while the S&P 500 and Nasdaq Composite lost 9.3% and 10.5%, respectively.

For the quarter, the Dow fell 6.66% to notch a three-quarter losing streak for the first time since the third quarter of 2015. Both the S&P and Nasdaq Composite fell 5.28% and 4.11%, respectively, to finish their third consecutive negative quarter for the first time since 2009.

The rally Monday is unsurprising considering how oversold markets have been, according to Sam Stovall, CFRA chief investment strategist.

"Because the S&P was down more than 9% in September... because the ISM was weaker than expected – ditto for construction spending – people are now surmising, 'Hey, maybe the Fed won't be as aggressive,'" he told CNBC. "As a result, we're seeing yields come down, we're seeing the dollar weaken. Those factors are contributing to the move we're seeing today."

Nine of the S&P's 11 sectors finished the previous quarter in negative territory.

Investors were just starting to lose hope for a fourth-quarter comeback, but Stovall said the market could still get one, noting that year-end rallies are historically stronger in midterm election years.

"We could see a rally because these fourth-quarter midterm election years are the second-best average quarter and also have the second-highest frequency of advance," he said. "The best one is the next one, meaning the first quarter of the third year. We could be surprised with at least a near-term upward movement."

Lea la cobertura del mercado de hoy en español aquí.

Stocks close higher to kick off October trading

The major averages retained their gains throughout the day Monday to end their first trading day of October and of the fourth quarter of the year on a high note.

The Dow Jones Industrial Average ended the day 764.52 points, or 2.7%, higher at 29,490.03. The S&P 500 rose 2.6% to 3,678.43, after falling Friday to its lowest level since November 2020. The Nasdaq Composite advanced 2.3% to end at 10,815.44.

— Tanaya Macheel

Utilities are among leaders on first day of new quarter, helped by falling yields, weaker natgas and deals

Utility stocks are helping to lead the broader market higher, alongside energy and materials shares Monday. The Utilities Select Sector SPDR Fund rose as much as 3.5%. NextEra — accounting for one sixth of the ETF — gained 3.7%, while Southern Co. added as much as 3.4%, and Duke Energy climbed 3.2%.

Utilities carry so much debt and have such demanding refinancing needs that they often get a lift from falling bond yields. Utilities' above-average dividend yields also face less competition when Treasury yields weaken. The 10-year Treasury yield got as low as 3.58% Monday, down from 3.83% Friday.

Meanwhile, near month Henry Hub natural gas futures are falling 4% — the only contract in the energy complex that's weaker.

Utility investors also saw Monday deal flow: Con Ed agreed to sell its Con Edison Clean Energy Businesses to Germany's RWE for an enterprise value of $6.8 billion, while Algonquin Power will sell stakes in U.S. and Canadian wind farms to InfraRed Capital Partners.

Finally, Credit Suisse began research coverage on five utilities Monday: Dominion Energy, Exelon and Constellation Energy were rated outperform while Alliant Energy and Edison International were rated neutral.

Con Ed is ahead 3.5%, Algonquin is rising almost 5%, Dominion is higher by 3.1% Exelon by 2.8% and Constellation by 3.8%.

— Scott Schnipper, with reporting by CNBC's Michael Bloom

The bond market often misses on Fed expectations, economist says

The bond market has been a poor predictor in the past of when the Federal Reserve is ready to start cutting interest rates, according to research from Joseph LaVorgna, chief economist at SMBC Nikko Securities.

Looking at the past three tightening cycles — 1999-2000, 2004-06 and 2015-18 — investors expected the Fed to hold rates higher for longer, only to miss the mark when the central bank was forced into cutting much sooner than expected.

"Historically, the bond market does not anticipate a Fed pivot," LaVorgna said in a client note. "While there is a small pivot priced into the Eurodollar curve next year, the recent past suggests that a shift in policy could be dramatic Hence, interest rates could be on the cusp of a big rally if the Fed pivots sooner than many investors expect."

In May 2000, the benchmark fed funds rate topped at 6.5%, with investors expecting 7.25%. The Fed started cutting later that year amid a pop in the dotcom bubble. Again in 2006, investors priced in a Fed leaving rates around 5.25%, but the financial crisis forced the central bank's hand. Finally, in late 2018, markets were pricing in a funds rate of 3% by the end of 2019, but the Fed had to cut that year due to economic weakness.

Traders currently are pricing in 1 percentage point, or 100 points, of rate increases through the end of this year, then the Fed leaving rates at that level into early 2024. However, LaVorgna's research indicates the market may be too hawkish.

—Jeff Cox

JPMorgan picks its top stocks for October

On Monday, JPMorgan released its favorite stock ideas for October.

The list includes spans across sectors and includes both value and growth names its analysts like.

Amazon, which has taken a beating this year, was among those that made the cut. JPMorgan's $185 price target implies almost 64% upside from Friday's close.

To read the full CNBC Pro story, and see more names on JPMorgan's list, click here.

— Michelle Fox

Chip stocks outperforming

Semiconductor stocks are one of the group's leading Monday's broad rally, helping to cut into some of the sector's big losses for the year.

The PHLX Semiconductor Sector Index was up more than 4% in afternoon trading. Among individual names, shares of Intel were up 5.4%, while Advanced Micro Devices climbed 4.8%. Chip giant Nvidia also added more than 3%.

Semiconductor stocks are often seen cyclical names, and have struggled as investors have soured on the global economic outlook. The PHLX Index is still down 39% year to date.

– Jesse Pound

S&P Global Market Intelligence: Surging dollar helps curb inflation in manufacturing

Consumers should see lower prices within manufacturing as the surging U.S. dollars helps bat down inflation, one economist said.

Manufacturers are reporting a growth in order books for the first time in four months in September while experiencing lower costs, according to Chris Williamson, chief business economist at S&P Global Market Intelligence. Input costs rose at a slower pace in September and providers raised prices at a slower rate than earlier in the year.

"While the strong dollar is curbing exports, a beneficial effect from the greenback's strength is being seen via lower import costs," Williamson said. "With supply chain delays also easing substantially again in September and shipping costs falling, upwards pressure on firms' costs has moderated sharply, which will feed through to lower goods prices to consumers."

But manufacturing will still drag on the broader economy, he said, with even more demand needed to make the industry positively contribute to gross domestic product. Despite seeing more stability in the supply chain, the industry ran through pre-production inventories for the first time since February 2021.

— Alex Harring

Wall Street is growing confident a Fed pivot could come by December, Oanda's Moya says

It's too early to call an end to the Federal Reserve's aggressive tightening cycle but Wall Street is growing increasingly confident that an end could come later this year, according to Oanda's Ed Moya.

"It is premature to say that the Fed is almost done with tightening, but it seems Wall Street is growing confident that they could be done in December," he said in a note to clients Monday. "Investors are starting to doubt central banks globally will remain aggressive with fighting inflation as financial stability risks are growing."

Bond yields fell on Monday after topping multi-year highs in September. Moya called the move in the Treasury markets a potential sign of rising optimism among traders.

"It is too early to call for a Fed pivot, but it seems the action in Treasury markets suggests traders are growing confident that the global growth slowdown is starting to drag down pricing pressures," he said.

— Samantha Subin

Finding safety in the bear market: CNBC Pro's latest stock screen

It's been a rough 2022 for Wall Street as the S&P 500 finished its third consecutive down quarter in a row on Friday for the first time since 2009 and its worst month since March 2020.

It's difficult for investors to stay hopeful in an environment consumed by surging inflation, a war in Ukraine and a Federal Reserve that shows few signs it will slow its tightening pace, but some safe havens do exist in this period of volatility.

CNBC Pro conducted a screen to locate some of those names, which included a popular energy stock and semiconductor company.

Subscribers to CNBC pro can check out the full list of stocks that made the cut here.

— Samantha Subin

Market has not hit contrarian low yet, two investment strategists say

The market is likely to see a near-term bounce, but a contrarian indicator that signals an upswing hasn't been hit yet, said two investment strategists.

A bear market needs to see internal pressures cool while a handful of stocks continue going lower before a bounce usually occurs, according to Todd Sohn, a director at Strategas, and Ross Mayfield, an investment strategy analyst at Baird Private Wealth Management.

The pair also pointed to the Chicago Board Options Exchange's CBOE Volatility Index, known as the "fear gauge," which remains around 30. It would typically be around 40 to signal the type of panic typically seen at major lows.

"We're just surprised that there's a lack of major panic despite stocks being in a long bear market," Sohn and Mayfield said. "Ultimately, I think you need to stay patient here."

— Alex Harring

Brazil stocks rally after Bolsonaro forces run-off in presidential election

Brazilian stocks rallied Monday after President Jair Bolsonaro forced a run-off vote in this year's election against former President Luiz Inacio Lula da Silva.

The iShares MSCI Brazil ETF (EWZ) popped more than 9%, led by a 21% pop in water and waste management company Companhia de Saneamento Basico. Oil giant Petrobras also popped more than 11%. The EWZ was on pace for its biggest one-day gain since March 24, 2020 — when it popped 12.1%.

Bovespa, Brazil's benchmark stock index, also rose more than 4% and was headed for its best day since May 2020.

Lula, a leftist, beat out Bolsonaro by 5 percentage points in the first round of voting, which was held Sunday. However, that margin was slimmer than many expected. Bolsonaro is seen as a more market friendly candidate in Brazil, promising reform and privatizations across several sectors of the economy.

— Fred Imbert

Stocks making the biggest moves midday: Credit Suisse, Tesla and more

These are some of the stocks making the biggest moves during midday trading on Monday.

- Credit Suisse — Shares of Credit Suisse rose 1.7%, reversing an earlier slump that sent the stock to a record low, after the bank over the weekend made a series of calls to calm investor fears about its financial health.

- Tesla — Tesla shares dropped 8.2% after the electric vehicle maker said it delivered 343,000 vehicles in the third quarter, less than analysts expected. Wall Street analysts were divided over the report, however.

- Peloton — Peloton shares rose more than 6% after the exercise-equipment company announced it will put bikes in all 5,400 Hilton-branded hotels in the U.S. as it tries to engineer a turnaround.

Read the full list of stocks moving midday here.

— Tanaya Macheel

25 S&P 500 stocks fall to fresh lows but now nearly all turn positive

Twenty-five stocks in the S&P 500 breached new 52-week lows during midday trading. They've since nearly all turned positive on the session.

Meanwhile, Nielsen was the only stock that hit a new 52-week high, trading at levels not seen since May 2021.

Here are some of the other names.

- Carnival trading at lows not seen since Oct, 1992 (but now dipping in and out of positive territory on session)

- Southwest trading at lows not seen since May, 2020 (but currently up over 1% on session)

- Colgate-Palmolive trading at lows not seen since May, 2020 (but now positive on session)

- DENTSPLY trading at lows not seen since Aug, 2010 (but now up over 2% on session)

- Tyson Foods trading at levels not seen since Feb, 2021 (but now positive on session)

- BlackRock trading at lows not seen since Sep, 2020 (but now up almost 2% on session)

- Invesco trading at lows not seen since Nov, 2020 (but now up over 5% on session)

- Fidelity National Information Services trading at lows not seen since Feb, 2017 (but now up more than 1.2% on session)

- Nike trading at lows not seen since Apr, 2020 (but currently up over 1% on session)

- Aptiv trading at lows not seen since Aug, 2020 (but currently up over 4% on session)

- UPS trading at lows not seen since Mar, 2021 (but now up almost 1% on session)

— Gina Francolla, Sarah Min

Credit Suisse lowers its year-end S&P 500 target, but sees an up year for 2023

Credit Suisse is among the Wall Street firms cutting its end-of-year target on the S&P 500.

The firm lowered its target to 3,850 from 4,300. The new figure still implies upside of 7.4% through the end of the year. It also initiated its 2023 target at 4,050. These forecasts are based on updated EPS estimates of $227, $230, and $240 for 2022, 2023 and 2024, respectively.

Citi also slashed its year-end target{=null} on the stock index on Sunday.

— Tanaya Macheel

Viasat surges after announcing deal with L3 Harris

Shares of Viasat jumped 39% on Monday morning after defense contractor L3 Harris announced a deal to acquire the communications company's tactical data links business. The deal is for just under $2 billion, the companies announced.

Viasat said it would use the cash to reduce its leverage and increase liquidity. At the end of June, the company reported having about $222 million in cash and cash equivalents versus more than $2.5 billion in senior notes and other long-term debt.

Prior to the announcement, Viasat's stock was down 32% for the year.

Shares of L3Harris rose 3.7% on Monday.

—Jesse Pound

`This is not 2008’— Credit Suisse situation not dire, according to Citigroup

Though Credit Suisse is currently being buffeted by a falling stock price and widening credit default swap levels, Citigroup says they don't believe the European bank is in dire trouble.

"This Is Not 2008," Andrew Coombs said Monday in a research note. "We would be wary of drawing parallels with banks in 2008 or Deutsche Bank in 2016."

Back in 2008, plunging share prices and widening credit default swap levels prompted a wave of consolidations in the U.S. bank sector. Stronger banks like JPMorgan Chase and Wells Fargo acquired weaker institutions.

But Credit Suisse's common equity Tier 1 capital, a key measure tied to the bank's ability to absorb financial shocks, was 13.5% as of the second quarter. That is "high vs peers," Coombs wrote. The bank's "liquidity position is very healthy," he added.

"The market appears to be pricing in a highly dilutive capital raise," the Citigroup analyst wrote. "We do not think this is a foregone conclusion, so would argue CS is a buy for the brave at these levels."

—Hugh Son

Market still not oversold enough, strategists say

Monday's bounce for the market could be a relief rally after the dramatic selling in September, but many Wall Street technical strategists are skeptical that the market decline is over.

Though several indicators, such as investor sentiment and the breadth of the selling, suggest the market could be near a bottom, several strategists said in their weekend notes that market probably needs to fall further before the selling is exhausted.

"On a near-term basis, more tactical capitulation may be needed," Bank of America's Stephen Suttmeier said in a note to clients.

Read more technical analysis at CNBC Pro.

— Jesse Pound

Energy stocks lead the market higher

Energy stocks were the top gainers in the S&P 500 Monday morning as oil price jumped, after they'd been slumping since June. The sector was higher by 4.6%.

Marathon Oil gained about 7%. APA Corp., Devon Energy and Halliburton rose about 6% each. Diamondback Energy, Conocophillips and Occidental advanced by about 5% each.

— Tanaya Macheel

ISM manufacturing PMI dips, now teetering on potential contraction

A gauge on the U.S. manufacturing sector fell last month, indicating that economic activity in the space is close to contracting.

The Institute for Supply Management said Monday that its manufacturing PMI fell to 50.9 in September from 52.8 in August — barely in expansion territory. A print below 50 indicates contraction, and one above that level points to an expansion.

The new orders and prices indexes — two key components of the overall PMI —fell to 47.1 and 51.7, respectively. The latter reached its lowest level since June 2020.

"The U.S. manufacturing sector continues to expand, but at the lowest rate since the pandemic recovery began," Timothy R. Fiore, chair of the ISM Manufacturing Business Survey Committee, said in a statement. "Following four straight months of panelists' companies reporting softening new orders rates, the September index reading reflects companies adjusting to potential future lower demand."

— Fred Imbert

Stocks jump at the open to start the month and final quarter of the year.

Stocks rose to start the new month, and quarter, on a solid note after capping a brutal September.

The Dow Jones Industrial Average rose 330 points, or 1.1%. The S&P 500 rose 1% after falling Friday to its lowest level since November 2020. The Nasdaq Composite gained 0.6%.

— Tanaya Macheel

Stocks making the biggest moves premarket

These companies are making headlines before the bell:

- ViaSat – ViaSat rallied 5.9% in premarket trading after the Wall Street Journal reported that the satellite company was close to a deal to sell a military communications unit to defense contractor L3Harris Technologies for nearly $2 billion.

- Myovant Sciences – Myovant surged 31.3% in the premarket after the biopharmaceutical company rejected a bid by its largest shareholder, Sumitovant Biopharma, to buy the shares it doesn't already own for $22.75 per share. Myovant said the offer significantly undervalues the company.

- Box – Box jumped 3.7% in the premarket after Morgan Stanley upgraded the cloud computing company's stock to "overweight" from "equal-weight," pointing to strong execution and a favorable competitive landscape.

Check out more premarket movers here.

— Tanaya Macheel, Peter Schacknow

Stocks will continue to fall without Fed pivot, Morgan Stanley's Wilson says

Morgan Stanley equity strategist Mike Wilson, who has been consistently bearish this year as the market's comeback attempts have failed, said that stocks still have further to fall unless the Federal Reserve makes a dramatic shift in its approach to fighting inflation.

"Bottom line, in the absence of a Fed pivot, stocks are likely headed lower. Conversely, a Fed pivot, or the anticipation of one, can still lead to sharp rallies," Wilson wrote in a note to clients on Sunday.

However, he cautioned that the central bank changing course may be just a short-term fix for equities.

"Just keep in mind that the light at the end of the tunnel you might see if that happens is actually the freight train of the oncoming earnings recession that the Fed cannot stop," Wilson wrote.

—Jesse Pound

Oil jumps as OPEC+ considers largest output cut since 2020

Oil prices rose Monday as the Organization of Petroleum Exporting Countries (OPEC+) considers cutting output by 1 million barrels per day, the largest cut since the start of the pandemic in 2020. Reducing output would boost prices.

West Texas Intermediate crude rose 4.15% to $82.79 per barrel. Brent crude futures gained 3.92% to $88.48 per barrel.

Oil prices have been slumping since June, weighed down by continued Covid lockdowns hurting energy demand in China.

—Carmen Reinicke

Citi cuts year-end S&P 500 target

Citigroup's chief U.S. equity strategist Scott Chronert slashed his 2022 S&P 500 target to 4,000 from 4,200 on Sunday. He's also predicting a down year for the index next year, establishing a year-end target of 3,900.

This year's lowered target still implies an 11% increase as Chronert believes the risk of a recession is already priced in. Citi puts the odds of a mild recession at 60% in the first half of next year.

To read the full CNBC Pro story, click here.

— Michelle Fox, John Melloy

Wall Street divided on Tesla's future following earnings

Shares of Tesla were down 4.3% in premarket trading Monday after the electric vehicle maker reported fewer than expected deliveries during its third quarter.

Tesla delivered about 343,000 vehicles, which came in below StreetAccount's estimate of 364,660 vehicles.

Wall Street is split on how the stock will perform going forward as the company navigates an uncertain macroeconomic backdrop that could weigh on demand. CNBC Pro subscribers can read more here.

— Alex Harring

Goldman Sachs upgrades Wells Fargo

Goldman Sachs said Wells Fargo is a buy at current levels, noting that the bank stock can go up nearly 20% from here.

"We see WFC as an underappreciated earnings growth story, due to best-in-class revenue upside and efficiency improvement from rates and loan growth-driven NII, and further idiosyncratic expense rationalization potential as it laps regulatory related cost inflation and continues to rationalize the business footprint," Goldman's Richard Ramsden wrote in a Monday note.

CNBC Pro subscribers can read more here.

— Sarah Min

British pound rebounds after UK government makes U-turn on tax cuts for high earners

The British pound recovered from earlier losses against the U.S. dollar after the U.K. government abolished a plan that would reduce taxes on high earners.

Sterling last traded 0.1% higher against the dollar at $1.117.

Originally, the new U.K. government had announced several tax cuts that were poorly received by financial markets. Among these was a move that would lower the top tax rate on incomes over £150,000 ($166,770) to 40% from 45%.

— Fred Imbert, Jenni Reid

European stocks slump, following gloomy sentiment in Asia-Pacific; Credit Suisse down 9%

The pan-European Stoxx 600 index dropped 1% in early trade, with financial services stocks shedding 1% to lead losses while oil and gas stocks added 1.3%.

The decline in Europe comes after a gloomy trading session in Asia-Pacific markets, with sharp moves in the price of oil.

Shares of Credit Suisse plunged nearly 10% during morning trade in Europe after the Financial Times reported that the Swiss bank's executives are seeking to reassure major investors about its financial health.

- Elliot Smith

CNBC Pro: Investment pro says ETFs are a $10 trillion opportunity — and reveals areas of ‘tremendous' value

Exchange-traded funds offer the benefit of diversification, says Jon Maier, chief investment officer at Global X ETFs. He said the ETF market is "growing exponentially" and estimates it to be worth $10 trillion.

He names several opportunities for ETF investors in this volatile market.

Pro subscribers can read more here.

— Zavier Ong

ANZ sees significant chance of an OPEC+ cut as large as 1 million barrels per day

Ahead of an OPEC+ meeting on Oct. 5, ANZ sees a "significant chance of a cut" as large as 1 million barrels per day, analysts at the firm said in a note.

That move is likely to be made "to counteract the excessive bearishness in the market."

The note added that any production cuts below 500,000 barrels per day, however, would be "shrugged off by the market."

–Jihye Lee

CNBC Pro: The five global stocks experiencing the de-globalisation trend, according to HSBC

New research from HSBC says supply chains, geopolitical tensions, and worsening financial conditions have forced many global companies to "substantially" turn inward in search of resilient revenue and growth.

In a tough economic environment with recessionary pressures, the bank said turning inwards is "probably helpful" for these stocks.

The report titled 'A de-globalisation wave?' said European firms' foreign sales dipped below 50% in 2021, the lowest level in the last five years.

CNBC Pro subscribers can read more here.

— Ganesh Rao

Oil prices jump on reports of OPEC+ mulling production cut

Oil prices jumped after reports that OPEC+ is considering an oil output cut of more than a million barrels per day, citing sources.

Such a move would be the biggest taken by the organization to address weakness in global demand.

Brent crude futures jumped 3.3% to $87.97 per barrel, while U.S. crude futures also popped 3.21% to trade at $82.04 per barrel.

— Jihye Lee

Data suggests bigger S&P 500 drawdowns offer a greater potential return, LPL Financial's Gilbert says

Markets have sold off heavily this year with the S&P 500 starting October down nearly 25%.

While the outlook is murky ahead, historical data analyzed by LPL Financial's Barry Gilbert indicates that the average one-year return on the S&P 500 improves the more significant the pullback.

According to Gilbert, the one-year average return increases steadily beyond a 10% pullback in the market and as the selloff worsens. When the market is down between 20% and 25% — in line with current times — the return is 11.5% on average one year later.

"When markets are down, the natural bias is to sell," he said in a note to clients Friday. "But looking at history, the more the S&P 500 is down, the better it does in the next year, on average."

— Samantha Subin

Where all the major averages stand as the fourth quarter begins

The final quarter of 2022 is set to kick off Monday and cap off what's been a brutal year for the markets. Here's where all the major averages stand ahead of Monday's trading session.

Dow Jones Industrial Average:

- Down 20.95% for the year

- Sits 22.26% off its 52-week highs

- Finished its worst month since March 2020

- Capped its third consecutive down quarter for the first time since the third quarter of 2015

S&P 500:

- Down 24.77% this year

- 25.59% off its 52-week high

- Finished its worst month since March 2020

- Closed out its third negative quarter in a row for the first time since its six-quarter streak that ended the first quarter of 2009

Nasdaq Composite:

- Down 27.4% this year

- 34.77% off its 52-week highs

- September marked its worst month since April 2022

- Finished its third consecutive negative quarter in a row for the first time since its three-quarter streak ending the first period of 2009.

— Chris Hayes, Samantha Subin

Stock futures open slightly lower

Stocks futures opened slightly lower in overnight trading on Sunday.

Futures tied to the Dow Jones Industrial Average slipped 15 points, or 0.05%, while S&P 500 futures and Nasdaq 100 futures shed 0.19% and 0.42%, respectively.

— Samantha Subin