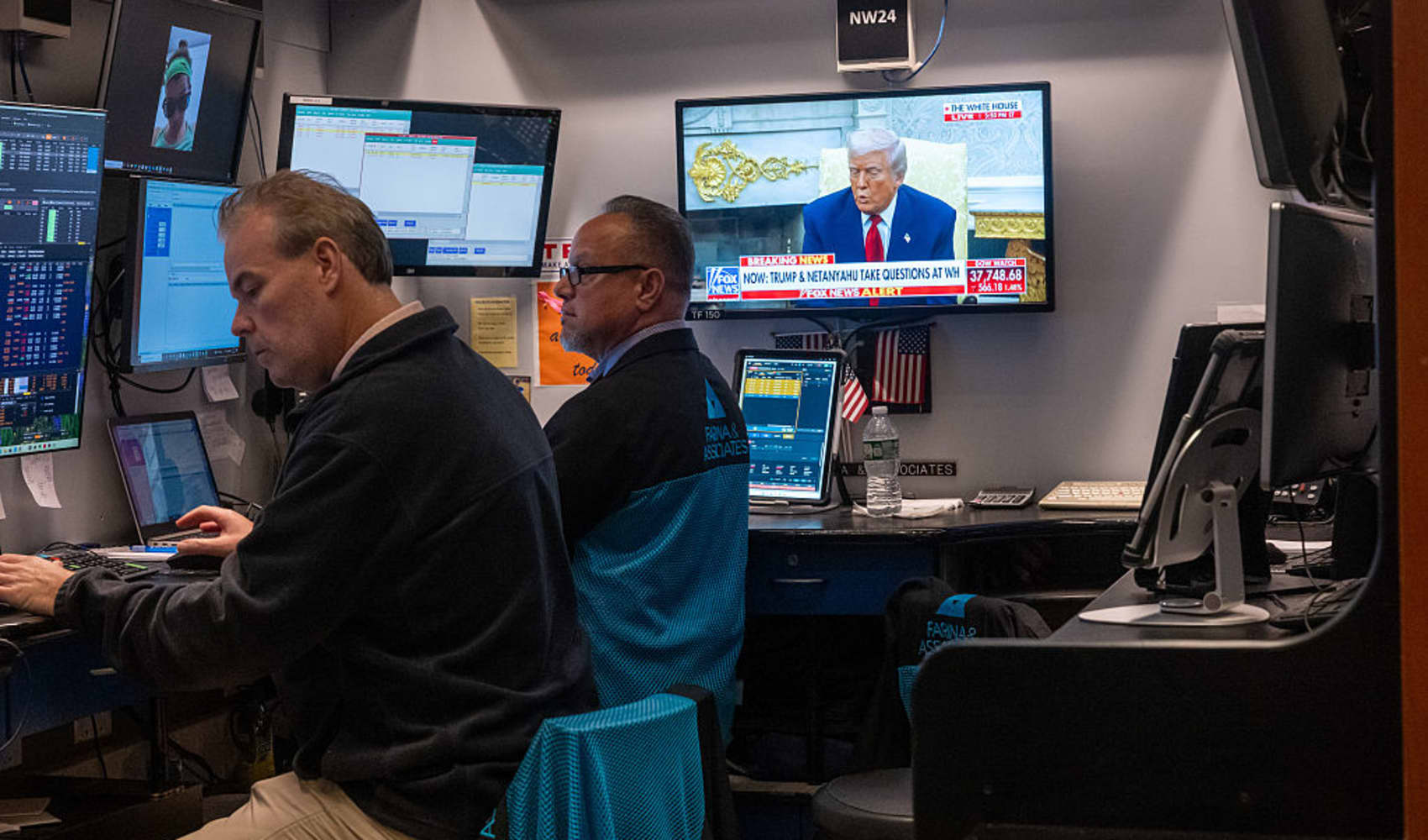

Traders work at the American Stock Exchange (AMEX) on the floor of the New York Stock Exchange at the closing bell in New York City, on April 4, 2025.

The stock market was pounded for a second day Friday after China retaliated with new tariffs on U.S. goods, sparking fears President Donald Trump has ignited a global trade war that will lead to a recession.

Here's a tally of the stock market damage:

- The Dow Jones Industrial Average dropped 2,231.07 points, or 5.5%, to 38,314.86 on Friday, the biggest decline since June 2020 during the Covid-19 pandemic. This follows a 1,679-point decline on Thursday and marks the first time ever that it has shed more than 1,500 points on back-to-back days.

- The S&P 500 nosedived 5.97% to 5,074.08, the biggest decline since March 2020. The benchmark shed 4.84% on Thursday and is now off more than 17% off its recent high.

- The Nasdaq Composite, home to many tech companies that sell to China and manufacture there as well, dropped 5.8%, to 15,587.79. This follows a nearly 6% drop on Thursday and takes the index down by 22% from its December record, a bear market in Wall Street terminology.

- The selling was broad with only 14 members of the S&P 500 higher on the day. Major market indexes closed at their lows of the session.

China's commerce ministry said Friday the country will impose a 34% levy on all U.S. products, disappointing investors who had hoped countries would negotiate with Trump before retaliating.

Get top local stories in Philly delivered to you every morning. Sign up for NBC Philadelphia's News Headlines newsletter.

Technology stocks led the bleeding Friday. Shares of iPhone maker Apple slumped 7%, bringing its loss for the week to 13%. Artificial intelligence bellwether Nvidia pulled back 7% during the session, while Tesla fell 10%. All three companies have large exposure to China and are among the hardest hit from Beijing's retaliatory duties.

Outside of tech, Boeing and Caterpillar — big exporters to China — led the Dow lower, falling 9% and nearly 6%, respectively.

"The bull market is dead, and it was destroyed by ideologues and self-inflicted wounds," said Emily Bowersock Hill, CEO and founding partner at Bowersock Capital Partners. "While the market may be close to the bottom in the short-term, we are concerned about the impact of a global trade-war on long-term economic growth."

Money Report

China's efforts to respond to Trump's tariffs extended beyond reciprocal duties of their own. Beijing added several companies to its so-called "unreliable entities list," which asserts that the firms have broken market rules or contractual commitments. In addition, China opened an antitrust investigation into DuPont on Friday, sinking shares nearly 13%.

The 10-year Treasury yield fell back below 4% Friday as investors flooded into bonds for safety, pushing prices up and rates lower. The CBOE Volatility index, Wall Street's fear gauge surged above 40, an extreme level seen only during rapid market declines.

Trump appeared to be steadfast in the face of the markets backlash to his tariff blitz announced Wednesday evening, posting on Truth Social Friday that his "policies will never change."

"The fear now as we go into the weekend [is] the trade war escalates, and the US doesn't back down," said Jay Woods, chief global strategist at Freedom Capital Markets.

All told, the S&P 500 dropped 9% on the week, its worst week since the breakout of Covid in early 2020.

Stocks close out a brutal week

Stocks closed lower on Friday, capping off a vicious week for investors as a result of President Donald Trump's tariffs. The wide-ranging duties prompted a retaliatory response from China and stoked concerns of a global economic slowdown that could touch every corner of the globe.

The Dow Jones Industrial Average lost 2,231.07 points, or 5.50%, to close at 38,314.86, while the S&P 500 fell 5.97% to 5,074.08. The Nasdaq Composite pulled back 5.82% to finish the session at 15,587.79.

The 30-stock Dow's decline was its biggest since June 2020. The S&P 500 notched its biggest decline since March 2020, while the Nasdaq entered a bear market, down more than 22% from its December high.

— Brian Evans

A secular rotation out of 'Mag 7' could pose deeper repercussions than questions about economic growth, Fidelity's Timmer says

A potential recession isn't as top-of-mind for Fidelity's Jurrien Timmer as the consequences of a more serious rotation out of the 'Magnificent Seven' megacap technology stocks.

"The market is so top heavy that if we are starting a secular rotation out of the Mag 7 into everything else (especially non-US equities), it is likely to have deeper repercussions than whether the economy is growing or not," Timmer, Fidelity director of global macro, wrote in an X post on Friday.

"The risk/return landscape is so lopsided towards the mega growers that it can become a systemic event for the markets. There's a lot of catching up to do if the Mag 7 reverts to the ACWI ex-US," he added.

Tech stocks plummeted on Thursday after President Donald Trump announced a slew of global tariffs, and the 'Mag 7' stocks lost more than $1 trillion in collective market cap that day. The group has continued their decline during Friday's sell-off.

— Pia Singh

Semiconductor ETF poised for worst week since 2001

The iShares Semiconductor ETF (SOXX) headed for its worst week in more than two decades as President Donald Trump's tariff policies wreaked havoc on technology stocks.

The fund has dropped more than 16% this week, hurt in part by Friday's slide of nearly 7%. If that holds, this would mark the biggest weekly loss for the ETF since September of 2001, when it plunged more than 25%.

After dropping more than 6% in Friday's session, the VanEck Semiconductor ETF (SMH) tracked to end the week down more than 14%. That means the fund is slated to record its worst weekly performance since March 2020, when it dove more than 15%.

Both funds hit lows not seen in more than a year during Friday's session.

— Alex Harring

S&P 500 nearing 'circuit breaker' territory

The S&P 500 traded more than 5.5% lower heading into the close, putting it near the 7% intraday decline that's needed to trigger a so-called circuit breaker. There are three circuit breaker levels:

- Level 1: The S&P 500 falls 7% intraday. If this occurs before 3:25 p.m. ET, trading is halted for 15 minutes. If it happens after that time, trading continues unless a level 3 breaker is tripped up.

- Level 2: The S&P 500 drops 13% intraday. If this occurs before 3:25 p.m. ET, trading stops for 15 minutes. If it happens after that time, trading continues unless a level 3 breaker is triggered.

- Level 3: The S&P 500 plunges 20% intraday. At this point, the Exchange suspends trading for the remainder of the day.

— Fred Imbert

Where markets stand with less than an hour until the closing bell

Stocks fell deeper into the red on Friday, with the sell-off pulling equities to levels not seen since the Covid-19 pandemic in 2020. Here's a look at where things stand with less than hour left of trading:

- The Dow Jones Industrial Average plummeted 2,027 points, or 5%, marking its biggest pullback since June 2020.

- The S&P 500 was 5.8% lower, also marking its biggest decline since June 2020.

- The Nasdaq Composite slipped 5.6%, and was also 22% below its record-high set in December, which indicates a bear market.

— Brian Evans

Energy sector faring even worse than broader market

Even in a broad market selloff on Friday, some equity sectors are significantly underperforming the index.

In late afternoon trading, the S&P 500 energy sector was down 8.6%, according to FactSet. A decline in oil prices is likely contributing to the the selling for that group. Meanwhile, economically sensitive financials dropped 7%.

Meanwhile, industrials and materials had declines of about 6% each.

The relative safehaven on the day is consumer discretionary, but even that beaten-down group has shed 3.6% on Friday.

— Jesse Pound

Bitcoin's Friday rise could indicate an equity market overreaction, says investor Jeff Kilburg

While equities melted down during Friday's trading session, bitcoin held its own, last rising approximately 1.8%, according to Coin Metrics.

Jeff Kilburg, founder and CEO of KKM Financial, pointed to the cryptocurrency's outperformance as proof that investors may be unduly punishing stocks.

"The equity markets are overreacting," he told CNBC in an interview. "Bitcoin has kind of been a beacon of risk ... if it was truly correlated to the NASDAQ — as it has been the last two, three quarters, if not year — bitcoin should be at $60,000, but it's not. So I think there's a lot of dispersion, which creates a ton of opportunity."

Kilburg added that uncertainty has been the driving force behind Friday's selloff.

"Right now, the bears are completely in control, as long as we have no visibility, no transparency, no idea," he said. "And the most frightening thing, which I think is cracking confidence, is that you can change things with one tweet."

— Lisa Kailai Han

Evercore ISI: China swiftly announced tariffs to purposely damage U.S. stock market

Evercore ISI thinks China's retaliatory response to U.S. tariffs had one objective: put more pressure on the U.S. equity market.

"It has become a full-on tariff war between the U.S. and China with Beijing, to our surprise ... Beijing pulled the trigger earlier since it used to announce responses on the effective dates of U.S. tariffs. Not all makes sense," Neo Wang, the firm's China strategist, wrote in a Friday note to clients.

"This earlier-than-expected announcement looks on purpose to inflict further damage on U.S. stock market while China is on holiday Friday and market closed," Wang said.

Beijing's measures may not be entirely sound, however, and could impact negotiations between China and the U.S., according to the firm. Read more here in CNBC Pro.

— Pia Singh

Palantir, Caterpillar and Apple are among Friday's biggest losers

Check out the companies making headlines in midday trading.

- Bank stocks — Major banks declined on Friday, as President Donald Trump's new tariff policies increasingly raised fears of a U.S. economic pullback. Shares of Goldman Sachs, Citigroup, Morgan Stanley and Wells Fargo tumbled about 8%. JPMorgan dropped 7%.

- Tesla, Palantir Technologies — Top picks among retail investors were not able to buck Friday's sell-off. Electric vehicle maker Tesla dropped around 10%, while defense technology stock Palantir tumbled 12%.

- Property stocks — Real estate stocks Prologis and Simon Property Group each slipped about 3% on Friday. Property stocks are sensitive to consumers' discretionary spending levels.

For the full list, read here.

— Pia Singh

Cryptocurrencies rise as global trade war deepens stock market slide

Bitcoin held its head above water after China retaliated against President Donald Trump's tariffs, while stocks continued to crater following their worst day since 2020.

The price of the flagship cryptocurrency was last higher by more than 2% at $83,463.72 on Friday, according to Coin Metrics. Most of the major cryptocurrencies were also in the green Friday. XRP and Solana gained 3% each and dogecoin jumped 6%.

Crypto-related stocks fell again, however, with Coinbase down about 8% and MicroStrategy down more than 1%. Meanwhile, spot gold fell 2.6% to $3,038.50 an ounce, while U.S. gold futures were down 2.9% at $3,020.79.

"Tariffs do affect the cost for U.S. builders, where inflation and higher goods cost make all this more expensive, presumably encouraging more capital flows and investment to Asia," said James Davies, CEO at crypto derivatives trading platform Crypto Valley Exchange. "The tariffs are reshaping global trade away from the U.S., reducing dollar reliance, changing funding rates and decoupling the U.S. … they impact everything, but crypto is robust. As its decentralized nature indicates, it should be a winner from this, even if the outcome for U.S.-domiciled crypto entities is much less clear."

For more, read our full story here.

— Tanaya Macheel

Tech companies hold off on IPOs as tariffs hamstring markets

Multiple technology firms have delayed going public as President Donald Trump's contentious tariff rollout batters the stock market.

Klarna and StubHub have both pushed back their initial public offerings due to recent market turmoil, a source familiar with the matter told CNBC. Both had filed IPO prospectuses in recent weeks.

The Wall Street Journal also reported Friday, citing sources, that Chime had kicked filling financials with regulators down the road. That also means the financial technology company was holding off on its IPO.

— Alex Harring, Annie Palmer, Leslie Picker

Trump administration should let countries negotiate tariffs, ex-Goldman CEO says

Former Goldman Sachs CEO Lloyd Blankfein believes President Donald Trump should let countries negotiate his newly announced "reciprocal" tariff rates.

"The switchboard at the WH must be burning up with gov'ts trying to surrender in this trade war. Why not give them a chance?" Blankfein said Friday in a post on X.

He added that Trump should allow the 10% baseline tariff to remain but delay the "reciprocal" tariffs by six months.

"Take the win! The Prez said he'd make us tired of winning…I'm there now!" he also said.

— Sean Conlon

Bob Doll says market can fall further

The stock market may seen more pain ahead, according to Bob Doll, president of Crossmark Global Investments.

"I'm not convinced we've yet seen the lows in the equity market," Doll said Friday on CNBC's "Squawk on the Street"

"At some point, we will get a tradable rally," he said. "But we're not out of the woods."

Doll said he's "beginning to lean against the wind" when it comes to investments. As an example, he said he would sell some Nvidia shares and buy Coca-Cola instead.

He also said "economic weakness is for sure coming." The probability of a recession has risen to 50% from 25% at the start of the year, he added.

— Alex Harring

Powell hints the Fed is not likely to bail the economy out anytime soon

Stock averages were not helped by comments from Federal Reserve Chair Jerome Powell, who said in a speech in Arlington, Virginia, that the central bank would wait and see the effect of President Trump's tariff blitz before making a move on rates.

"Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem," Powell said in prepared remarks. "We are well positioned to wait for greater clarity before considering any adjustments to our policy stance. It is too soon to say what will be the appropriate path for monetary policy."

Powell noted that the announced tariffs were "significantly larger than expected."

"The same is likely to be true of the economic effects, which will include higher inflation and slower growth," he said. "The size and duration of these effects remain uncertain."

The Dow was last down more than 1,300 points, extending losses as Powell spoke. The 10-year Treasury yield was at 3.94%.

— John Melloy, Jeff Cox

BlackRock's Rick Rieder says the world has been changed by tariffs

Rick Rieder, BlackRock's global fixed income chief investment officer, said tariffs created a sea change in economic activity and corporate America's confidence.

"The world has changed, and the economic conditions have changed. Indeed, this can be dramatically witnessed in the recent decline in CEO confidence," he said in a note. "And for multinationals, and small businesses, tariffs are dramatically influencing confidence in hiring, spending on capital expenditures, research and development, and potential mergers and acquisitions."

The widely followed bond chief said Friday's jobs report had little relevance to where hiring and economic confidence are headed over the coming months and quarters.

— Yun Li

Nasdaq Composite is on pace to close in a bear market

The technology-heavy Nasdaq Composite pulled back nearly 6% as of 10:51 a.m. ET on Friday.

If the index closes at this level, that represents a more than 21% fall from its record close in December and will confirm a bear market for the Nasdaq.

— Brian Evans

Cramer says Trump's tariff policy is risking a market crash

CNBC's Jim Cramer ripped into the White House for the effect that its tariff policy is having on the stock market.

"I struggle for what the president's game plan is because if you wanted to make the market crash, I think you would go with this game plan," Cramer said on "Squawk on the Street." "I don't like that game plan. I do not favor that. … It's very disappointing."

Cramer, who runs the CNBC Investing Club, added, "It should not be in our country's interest to have the market crash." He also said, "I respect our viewers' 401(k) and IRA, and I don't want them to be hurt for no reason because that's their bedrock and we don't want them to stop [investing]."

— Kevin Stankiewicz

DuPont, Estée Lauder sink on China tariffs

Shares of Dupont De Nemours and Estée Lauder fell sharply Friday on the heels of China's announcement of a 34% tariff on all products from the U.S.

Dupont was down 11% in early trading, while Estée Lauder lost 6%.

Both companies are big importers into China. In addition, the country's regulators launched an anti-monopoly investigation into Dupont on Friday, according to reports.

— Michelle Fox

NYSE decliners beating advancers 17-1

The number of declining stocks far outpaced those going higher Friday, as investors ran for safety following China's tariff retaliation. More than 17 New York Stock Exchange-listed stocks pulled back for every one advancer, FactSet data shows. Overall, 2,494 stocks fell, while only 143 were higher.

— Fred Imbert

Stocks open lower as sell-off continues

Selling pressure continued at the opening bell on Friday, with investors continuing to show signs of worry over Trump's escalating trade war.

The Dow Jones Industrial Average fell 1,024 points, or 2.5%. The Nasdaq Composite fell 3.1%, while the S&P 500 lost 2.8%.

— Brian Evans

JPMorgan downgrades 2 petrochemical stocks as trade war puts imports to China at risk

Petrochemical names Dow and LyondellBasell Industries could see some losses following President Trump's new reciprocal tariffs announcement, according to JPMorgan.

Shares of Dow and LyondellBasell pulled back more than 3% and more than 2%, respectively, in the premarket after analyst Jeffrey Zekauskas downgraded both names to neutral from overweight. His updated price target for Dow implies more than 1% downside ahead, while his updated target for LyondellBasell reflects about 5% downside, as of Thursday's close.

"It will be difficult for Dow and Lyondell to lift prices to widen out margins from current levels in the context of global economic deceleration and lower oil prices," he wrote in a Friday note. "The EBITDA of Dow or Lyondell can fall sharply under recessionary conditions as can their share prices."

Zekauskas also noted that China is a top destination of U.S. polyethylene exports, meaning the tons of that plastic that are exported to the country, as well as to Europe, might be adversely affected by retaliatory tariffs. On Friday, China announced a 34% tariff on all goods imported from the U.S. in response to Trump's new duties. Those retaliatory measures are set to take effect April 10.

The stocks have already seen a substantial pullback in recent months. Dow shares have plummeted more than 43% over the past six months and more than 21% year to date. Meanwhile, LyondellBasell shares have slid almost 35% over the past six months and more than 15% in 2025.

— Sean Conlon

U.S. jobs report tops expectations

The U.S. economy added more jobs than expected in March, with payrolls growing by 228,000. Economists polled by Dow Jones expected an increase of 140,000 jobs.

Investors largely looked past the report as worries over an escalating trade war overshadowed the employment figures.

— Fred Imbert

Lower spending from higher-income consumers could tip economy into recession, Bleakley CIO says

This week should see yet another market pullback amid global trade tensions, but worse could also be in store, according to Peter Boockvar, chief investment officer of Bleakley Financial Group.

"The stock market and the economy are tied at the hit. If the stock market continues to fall, if that negatively impacts upper income consumer spending, then you are going to dramatically raise the odds of a recession because it's happening at the same time that government spending — which, as I mentioned has been a huge boost to economic growth — is slowing the pace of its spending," Boockvar said Friday on CNBC's "Squawk Box."

"So there aren't that many stools left that the economy can sit on if we lose the stock market and if we lose upper income spending," he added.

On the other hand, Boockvar mentioned that a stock market rally could happen if courts block the Trump administration's tariffs.

— Pia Singh

Apple shares fall another 5% after China tariff retaliation

Apple shares tumbled another 5% in premarket trading after China announced retaliatory tariffs against the U.S.

The tech stock is set to add to a 9% decline Thursday after China said it will impose a 34% tariff on all goods imported from the U.S. starting April 10.

China accounts for around 80% of Apple's production capacity, with about 90% of iPhones assembled in the country, according to estimates from Evercore ISI.

China criticized Washington's decision to impose 34% of additional reciprocal levies on China — bringing total U.S. tariffs against the country to 54% — as "inconsistent with international trade rules."

— Yun Li

Volatility index spikes to highest level since August 2024

The CBOE Volatility Index, known as the VIX, jumped more than 9 points to 39.60 Friday morning. This marked the index's highest level since the yen carry trade unwinding in August 2024.

The VIX is commonly referred to as Wall Street's fear gauge. It measures future expectations of volatility through S&P 500 stock options.

— Hakyung Kim

10-year Treasury yield falls below 4%

The 10-year Treasury yield fell sharply again on Friday, breaking below the 4% level.

Shortly after 7 a.m. ET, the benchmark Treasury yield was down 17 basis points to 3.882%. A basis point is equal to 0.01 percentage points. Bond prices move opposite of yields.

The rally for bonds could be a sign that investors who are selling stocks are shifting their money to assets that are traditionally safer.

— Jesse Pound

China to hit U.S. goods with 34% retaliatory tariff

China's finance ministry on Friday said it will impose a 34% tariff on all goods imported from the U.S. starting April 10 in the wake of duties imposed by U.S. President Trump's administration earlier this week, according to state news outlet Xinhua.

The news sent U.S. stock futures tumbling to their session lows.

— Ruxandra Iordache

Europe stocks slide

Europe's Stoxx 600 index was 1.67% lower at 9:13 a.m. U.K. time, on track for a third straight day of sharp losses.

Banking stocks dropped 5.7%, while mining stocks lost 3.7%. The food and beverage sector bucked the trend to jump 1.1%.

Germany's DAX index was last down 1.74%, while the U.K.'s FTSE 100 and France's CAC 40 were both around 1.3% lower.

— Jenni Reid

Stocks head for losing week

After Thursday's steep sell-off, the three major indexes are on track to finish the week squarely in the red.

The Nasdaq Composite and S&P 500 have tumbled 4.5% and 3.3%, respectively, week to date. Both the Nasdaq and S&P 500 are tracking for their worst weekly performances since September 2024 and sixth negative week of the last seven.

The Dow has slid 2.5% this week.

— Alex Harring

Consumer staples, utilities shine in a tumultuous week for stocks

When markets get agitated, investors flee for what they know: snacks, groceries and utilities.

Consumer staples and utilities, traditionally defensive corners of the market, are on pace for positive weeks. Staples are up 2.4% week to date, while utilities are on track for a 1.2% advance.

Big winners among consumer staples include potato producer Lamb Weston, which surged 10% on Thursday and is on track for a 10% pop this week. The company caught a tailwind from fiscal third-quarter results that surpassed consensus estimates, per StreetAccount. The top bands of its full-year earnings and revenue guidance also topped the Street's estimates.

Dollar General, which is on track for a 9.7% week-to-date jump, and supermarket giant Kroger, up 6% this week, are also big winners in the staples category.

Among utilities, Exelon Corporation is the top performer this week, up 5.6% thus far. American Water Works and Duke Energy follow, both on pace to rise 3.9% during the period.

To sweeten the deal for investors, not only did these names survive Thursday's sell-off, but they are also all dividend payers. Consider that Exelon and Duke offer dividend yields in excess of 3%, while Dollar General and Lamb Weston have dividend yields that top 2%.

— Darla Mercado

GameStop rises after Ryan Cohen buys more shares

Shares of GameStop climbed nearly 3% in extended trading after a regulatory filing revealed CEO Ryan Cohen bought more shares of his video game retailer.

Cohen increased his stake to 37.3 million shares from 36.8 million shares. The meme stock dropped 7% Thursday amid a broad market sell-off triggered by Trump's tariff rollout.

GameStop recently raised $1.3 billion through the sale of convertible senior notes due in 2030 to buy bitcoin. The stock is down more than 32% this year.

— Yun Li

JPMorgan chief economist hikes global recession odds following tariff announcement

The odds of a global recession will rise to 60% if President Donald Trump's tariff plan goes forward as initially presented, according to Bruce Kasman, chief economist at JPMorgan.

Kasman previously had the likelihood set at 40%.

"We are not making immediate changes to our forecasts and want to see the initial implementation and negotiation process that takes hold. However, we view the full implementation of announced policies as a substantial macroeconomic shock not currently incorporated in our forecasts," he wrote to clients in a Thursday note. "We thus emphasize that these policies, if sustained, would likely push the [U.S.] and possibly global economy into recession this year."

— Alex Harring

Dow futures are lower

Dow futures were down shortly after 6 p.m. ET.

Futures tied to the blue-chip index and the broad S&P 500 both slipped 0.1% shortly after 6 p.m. ET. Nasdaq 100 futures sat near flat.

— Alex Harring