- Asia-Pacific markets mostly rose, after a choppy session overnight in the U.S. as investors awaited key inflation data.

- U.S. consumer price index for July, a key indicator of the health of the U.S. economy, will be released Wednesday.

- Over in Asia, investors assessed Japan's producer price index data and Singapore's second-quarter GDP growth numbers.

Japan's major indexes rose sharply on Tuesday, as trading in the country's stocks resumed after a holiday, amid a broader rise in Asia-Pacific markets.

Japan's benchmark Nikkei 225 jumped 3.45% to end the session at 36,232.51, breaching the 36,000 level for the first time since Aug. 2. The broader Topix gained 2.83% to close at 2,553.55.

The momentum was largely driven by the country's technology and financial sectors, with Rakuten Group and Trend Micro leaping 9.22% and 6.37%, respectively.

Get top local stories in Philly delivered to you every morning. Sign up for NBC Philadelphia's News Headlines newsletter.

The country's parliament plans to hold a special session next week to discuss the Bank of Japan's decision to raise interest rates last month, Reuters reported, citing government sources.

Japan's producer price index rose 3% in July from a year earlier, climbing at a faster pace compared to 2.9% in June.

South Korea's Kospi climbed 0.12% to wrap the session at 2,621.50, while the small-cap Kosdaq lost 1.02% to end at 764.86.

Money Report

Australia's S&P/ASX 200 climbed 0.16% to finish at 7,826.8. Wages in Australia rose 0.8% in the quarter ended June, the slowest pace since the same quarter a year earlier, compared with estimates of a 0.9% rise. Wages rose 4.1% on an annual basis.

Mainland China's CSI 300 ticked higher by 0.26%, to conclude the day at 3,334.39, while Hong Kong's Hang Seng index gained 0.32% during its last hour of trade.

In Southeast Asia, Singapore reported its economy grew 2.9% in the second quarter from a year ago, in line with the advance gross domestic product estimate released in July. The Ministry of Trade and Industry cited strength in the wholesale trade, finance and insurance as well as the information and communication sectors. The city-state also said it sees 2024 GDP growth of 2% to 3%, versus its previous forecast of 1% to 3%.

U.S. markets grappled with a choppy session overnight as investors braced for key inflation data.

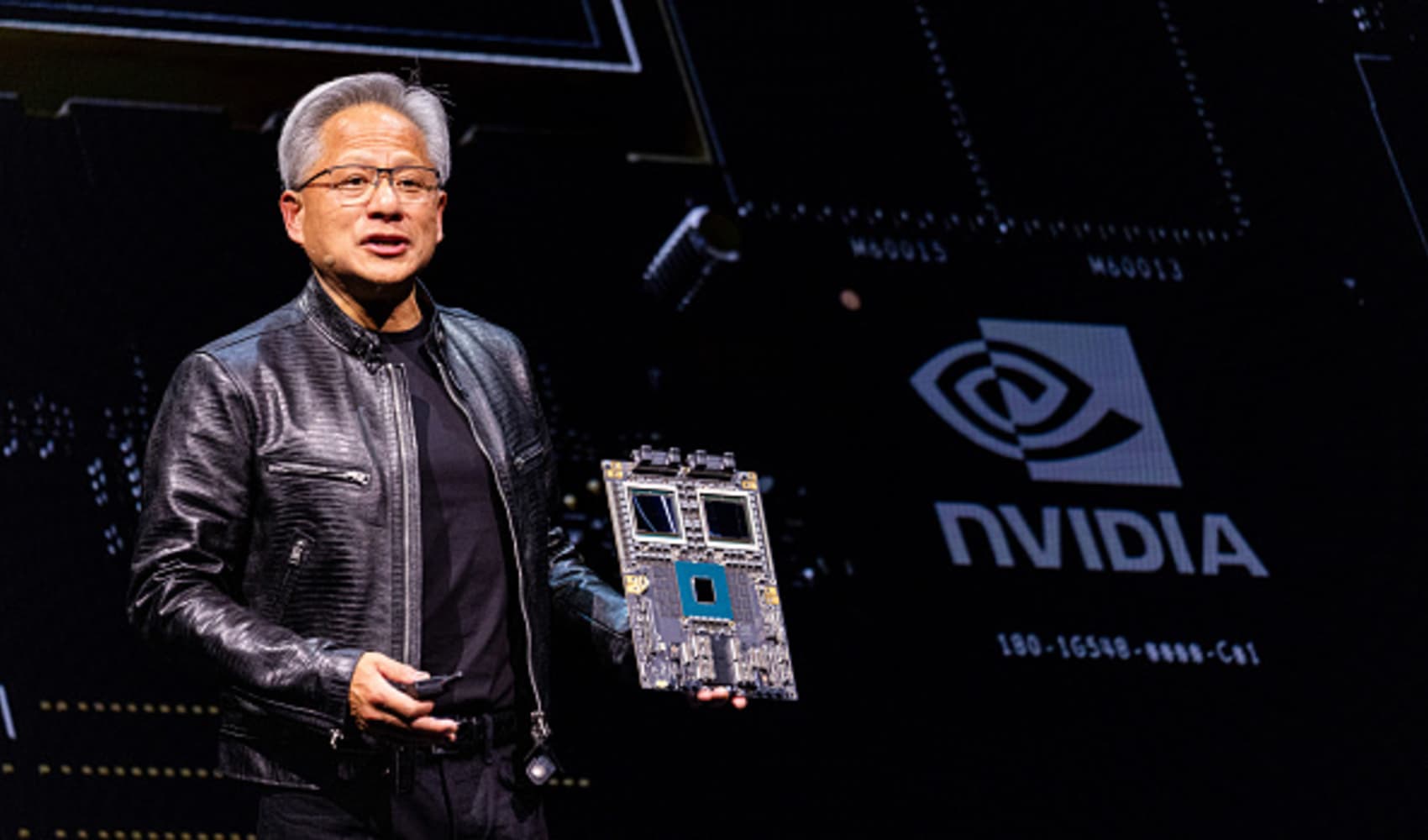

The S&P 500 concluded the day flat at 5,344.39, while the tech-heavy Nasdaq Composite climbed 0.21% to close at 16,780.61, led by shares of Nvidia soaring 4%. On the flipside, the Dow Jones Industrial Average fell 140 points or 0.36% to conclude at 39,357.01.

Traders await Wednesday's consumer price index for July, a key indicator of the health of the U.S. economy. Investors will analyze the data for indications the Federal Reserve can begin cutting rates in September.

—CNBC's Brian Evans and Tanaya Macheel contributed to this report.