This is CNBC's live blog covering Asia-Pacific markets.

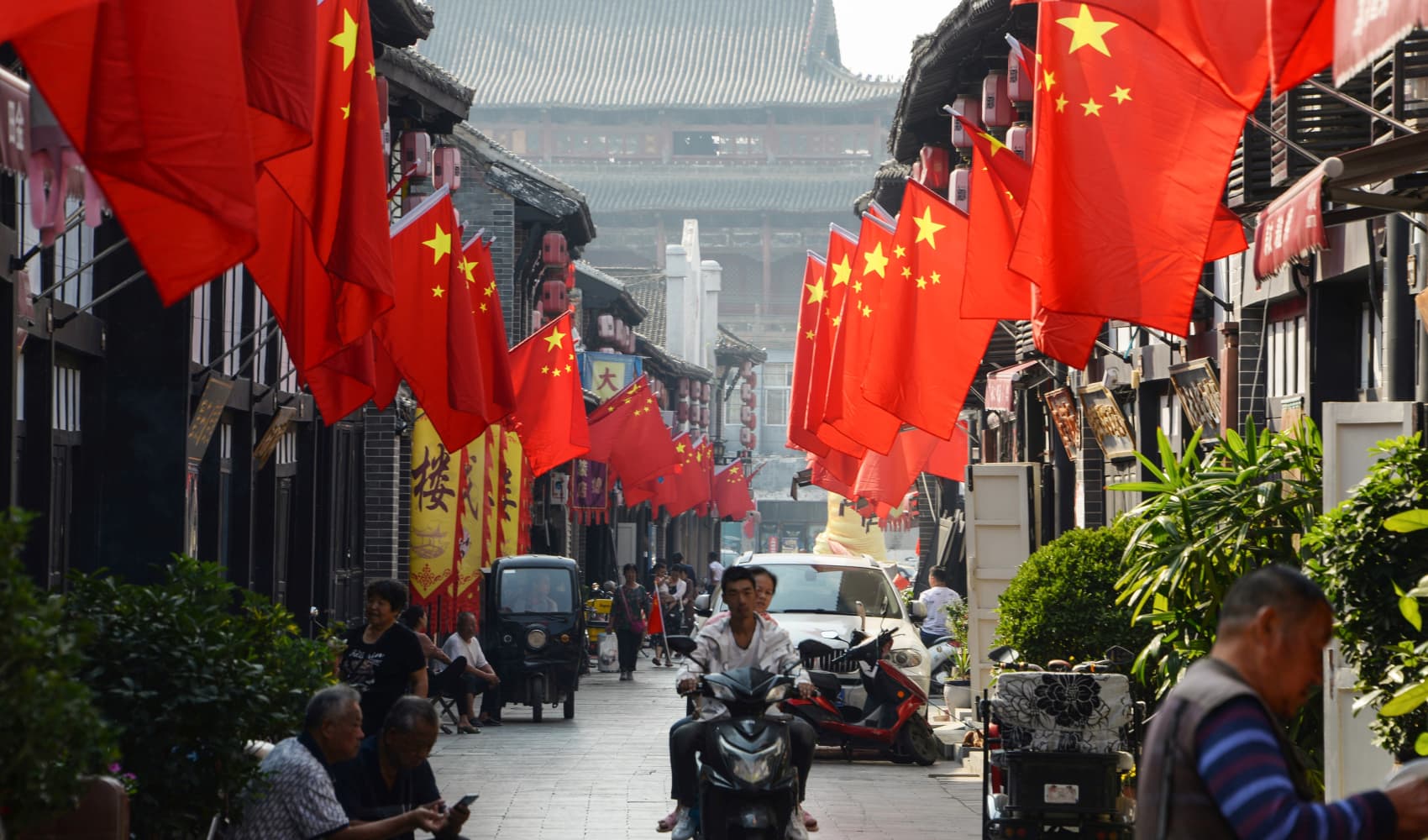

Asia-Pacific markets opened mixed Friday, as investors awaited key economic data from China and assessed Japan's inflation numbers.

China's third-quarter GDP is expected to come in at 4.5%, as estimated by economists in a Reuters poll, compared with 4.7% growth in the prior quarter.

China's house prices fell 5.8% year-over-year in September, a larger drop than 5.3% in August.

Get top local stories in Philly delivered to you every morning. Sign up for NBC Philadelphia's News Headlines newsletter.

For September, economists expect a mixed picture in China's economy, with urban investment estimated to grow 3.3% year on year, slower than 3.4% in the prior month, while retail sales could rise 2.5% on year, faster growth than last month's 2.1%, according to data from LSEG.

Industrial production is expected to expand 4.5% in September from a year ago.

Mainland China's CSI 300 was trading flat at market open. Meanwhile, Hong Kong's Hang Seng index gained 1.1% in early trading.

Money Report

Japan's headline inflation for September came in at 2.5%, while core CPI — which excludes fresh food prices — rose 2.4% year on year compared with Reuters estimates of 2.3%.

Japan's Nikkei 225 was trading 0.2% higher while the broad-based Topix rose 0.3%.

South Korea's blue-chip Kospi slipped 0.2%, while the small-cap Kosdaq was down 1.2%.

Australia's S&P/ASX 200 was down 0.7%.

Overnight in the U.S., the Dow Jones Industrial Average rallied to a new record close after strong economic data eased lingering fears of a potential recession. The blue-chip index rose 161 points, or 0.37%, to 43,239.05.

The S&P 500 closed down 0.02% to settle at 5,841.47 after hitting an intraday record earlier in the session.

The Nasdaq Composite rose 0.04% inched higher, as chipmakers rallied, to end at 18,373.61.

All three indexes are tracking for their sixth straight positive week.

— CNBC's Lisa Kailai Han and Hakyung Kim contributed to this report.

China funds pull back

The iShares MSCI China ETF (MCHI) headed for its worst week in about two years as investors continued pumping the breaks on trades tied to the Asian country.

The exchange-traded fund has dropped more than 8% this week. If that holds through Friday's closing bell, it would mark the worst week for the fund since October 2022, when it slid more than 9% in one week.

The KraneShares CSI China Internet ETF (KWEB) and iShares China Large-Cap ETF (FXI) also both tracked for their biggest weekly losses in more than a year.

Despite those drawdowns, all three funds are still up in 2024, underscoring the strength of their recent rallies.

— Alex Harring

See the stocks moving after hours

These are some of the stocks making notable moves in extended trading:

- Netflix — The streaming stock popped more than 4% after third-quarter earnings surpassed expectations. Netflix also said its ad-tier memberships jumped 35% quarter over quarter.

- Intuitive Surgical — Shares jumped about 5% after the maker of the da Vinci surgical robot released stronger-than-expected results for the third quarter. Intuitive Surgical earned $1.84 per share on $2.04 billion in revenue, while analysts surveyed by LSEG had predicted earnings of $1.63 per share on $2 billion in revenue.

— Alex Harring

Stocks head for winning week

Stocks are on track to finish the week with gains, extending recent winning streaks.

The Dow and S&P 500 have climbed 0.9% and 0.5%, respectively this week. The Nasdaq Composite has ticked up by almost 0.2%.

All three are on track to notch their sixth straight winning weeks. That would mark the longest weekly positive streaks for the Dow and S&P 500 in 2024.

Small caps have outperformed this week, with the Russell 2000 adding more than 2%.

— Alex Harring