Cryptocurrencies were in the crosshairs Thursday.

Bitcoin, ether and litecoin all tumbled as investors soured on riskier assets in favor of safe havens such as bonds.

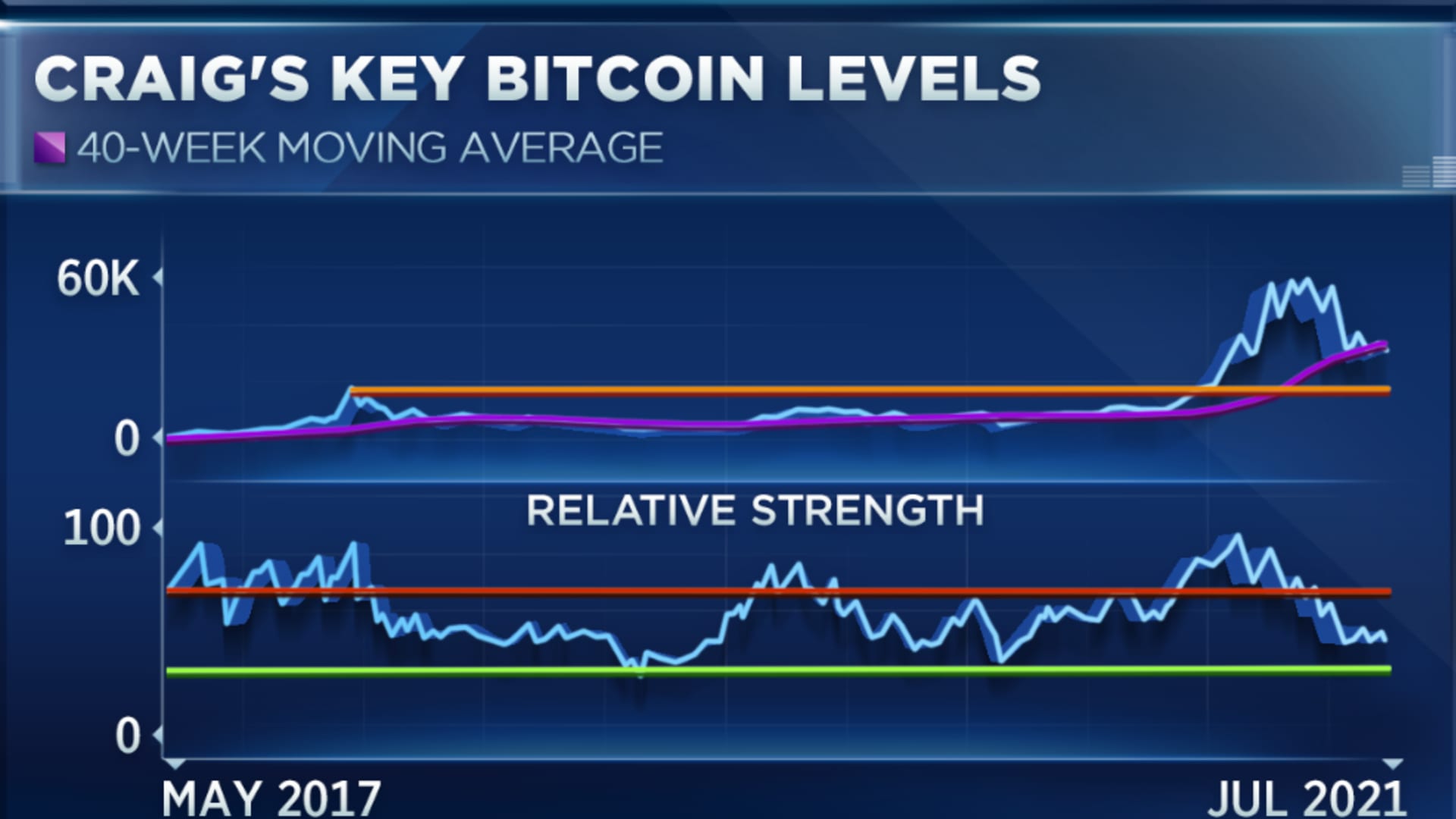

Craig Johnson, chief market technician at Piper Sandler, is watching the charts closely for which way bitcoin could break next.

Get top local stories in Philly delivered to you every morning. Sign up for NBC Philadelphia's News Headlines newsletter.

"We broke out in January. A few months ago, we made this peak. I actually would go back and put the retracement levels on top of bitcoin, and when you see that, you can see that around 33,000 to 34,000 is a very important retracement level," Johnson told CNBC's "Trading Nation" on Thursday, referring to Fibonacci retracement in technical analysis that marks key support and resistance levels.

Bitcoin has bounced between $31,500 and $34,800 for roughly two weeks. Johnson says that based on its history bitcoin is unlikely to drop much further. However, he does see a prolonged period of consolidation.

Money Report

"You've already seen bitcoin correct about 45%. When you go back to the last two prior cycles, those crypto cycles lasted about 1,000 days," he said. "You've got to be prepared to batten down the hatches and kind of wait for this to consolidate for quite some time longer before you start the next big major leg higher."

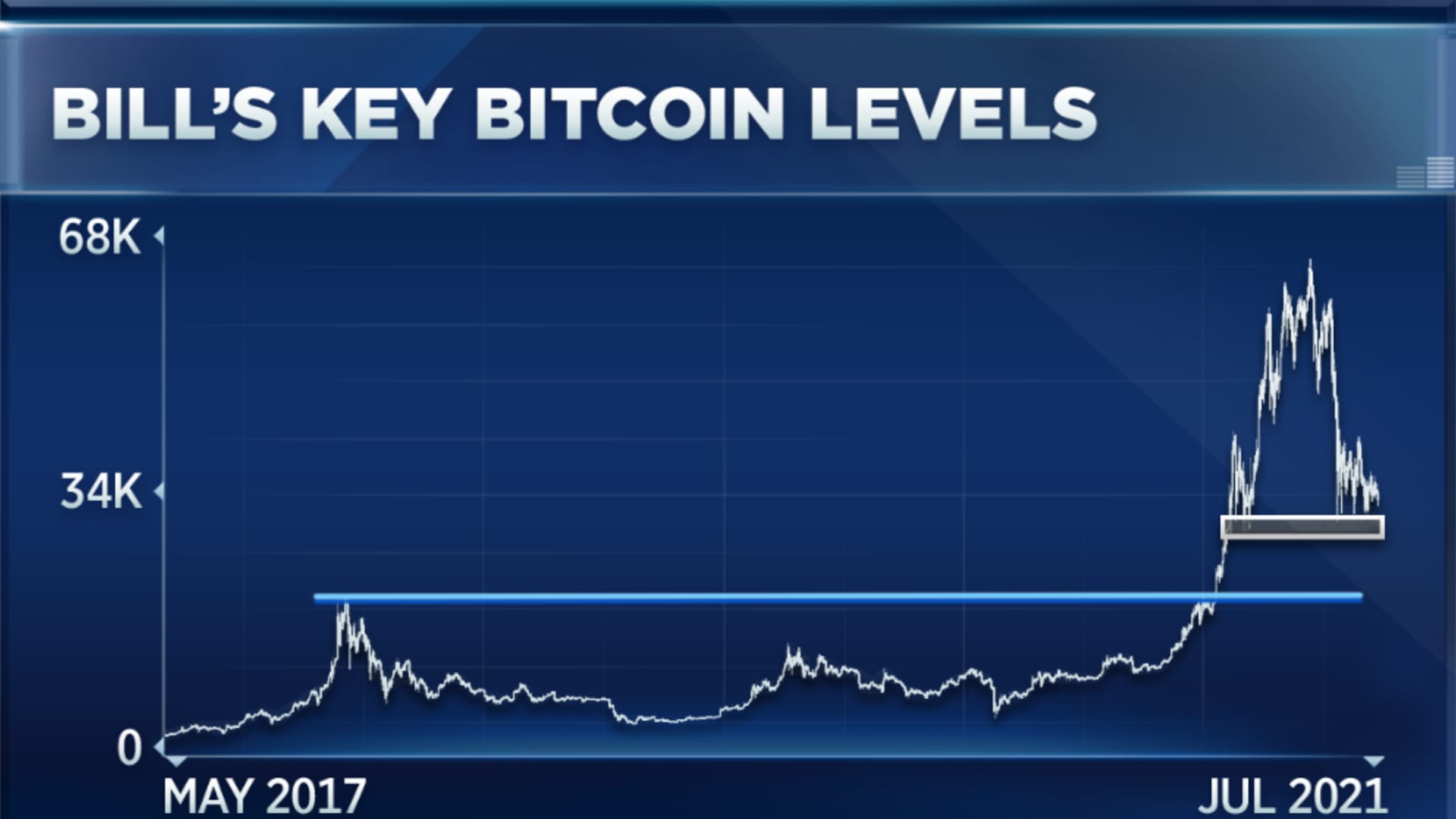

Blue Line Capital President Bill Baruch holds bitcoin and is waiting for the next opportunity to add to his position.

"Give me $25,000 on bitcoin, and I'd be buying more," Baruch said during the same segment.

"I've been in the space since 2017. There's times where I'm in it, there's times when I'm not, I totally exited through early this year," he said.

Baruch said he bought back into bitcoin when it reached $32,500. He also holds the cryptocurrencies ether and solana.

Bitcoin last traded at $32,870. It would need to fall 24% to reach Baruch's buy target level.